Steps to Register a Company in a Dubai Free Zone

- Obtain a business license: Valid for one year and renewable annually.

- Secure a UAE Residence Visa: For foreign investors and employees.

- Open a corporate bank account: Essential for financial transactions.

- Select a license type and business activity: Adhere to Free Zone regulations.

- Choose a corporate structure: Options include New Company, Subsidiary, Joint Venture, or Branch.

- Trade name registration: Propose three names in order of preference.

- Apply for initial approval: Confirm name, activity, and structure.

- Sign legal documents: Meet with Free Zone officials to finalize setup.

- Establish a business location: Secure a property and obtain the necessary certificates.

- Collect your business license and documents: Start your operations with full support.

Considerations for Dubai Free Zone Companies

Mainland business restrictions: Partner with a local distributor for mainland operations.

Visa limitations: Depending on Free Zone policies and business size.

Capital requirements: Some zones require minimum share capital.

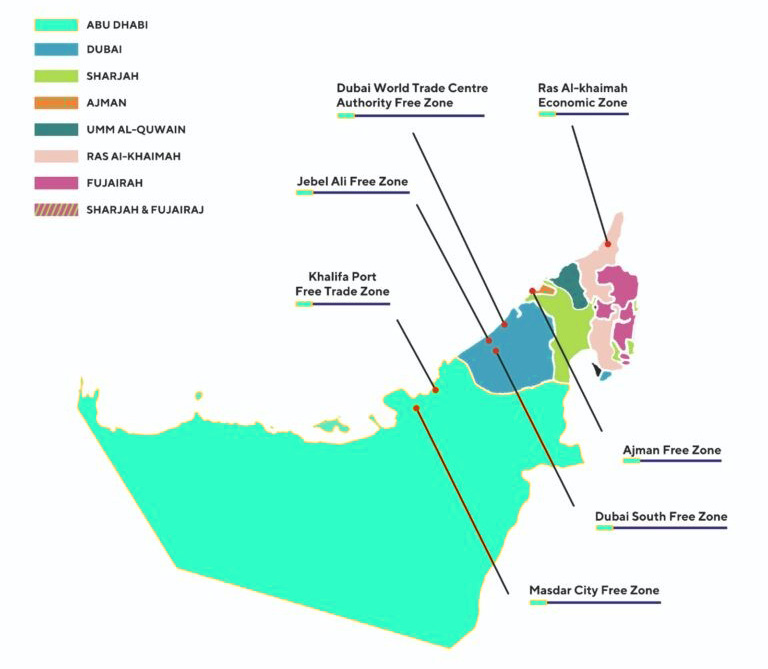

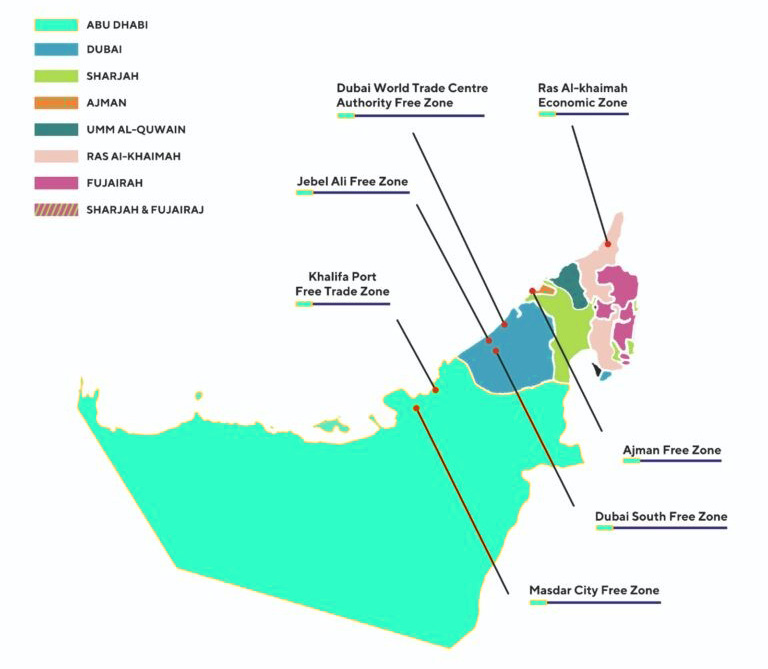

Choosing the Right Free Zone

Select a Free Zone that aligns with your business needs, considering factors like activity type, location, setup costs, visa quotas, and office space options. Professional advice is vital to navigate the selection and setup processes effectively.

For more information on company formation in Dubai Mainland, visit our page on Business Set-up in Dubai Mainland.

Our Services Include:

- Freezone selection consultation: helping determine which of the many Freezones best suits your business needs.

- Documentation preparation: full support in preparing and filing all necessary documents for registration.

- Licensing assistance: aiding in obtaining all necessary licenses, tailored to your business activities.

- Post-registration support: offering ongoing support in business operations, including accounting services and compliance consultations.

Interested in Freezone Business Registration?

Fill out the form on our website, call us, or send us a message via WhatsApp or Telegram for a free consultation. Our experts are ready to answer all your questions and assist you every step of the way.

What is a Freezone?

A Freezone is a special economic zone in the UAE designed to attract foreign investment. It offers benefits like 100% foreign ownership, tax exemptions, and no restrictions on profit and capital repatriation

What are the steps to register a company in a Freezone?

The registration process includes selecting a suitable Freezone, determining the legal form of the business, preparing and submitting required documentation, and paying the applicable fees

What types of business licenses are available in Freezones?

Freezones typically offer various licenses, including trading, manufacturing, service, and IT licenses, each tailored to specific business activities

Do I need a local sponsor to register a company in a Freezone?

No, a local sponsor is not required for Freezone companies. Foreign investors can own 100% of the company

What are the financial requirements for opening a company in a Freezone?

Financial requirements vary by Freezone and license type. Some Freezones require proof of capital, which also varies

Can I conduct business outside the Freezone with my Freezone license?

Typically, a Freezone license restricts business activities to within the Freezone or internationally. To operate in the UAE mainland, you may need additional licenses or registrations

What are the requirements for accounting and auditing for a Freezone company?

Most Freezones require companies to maintain proper accounting records and submit annual financial reports. Some also require annual audits

Рус

Рус